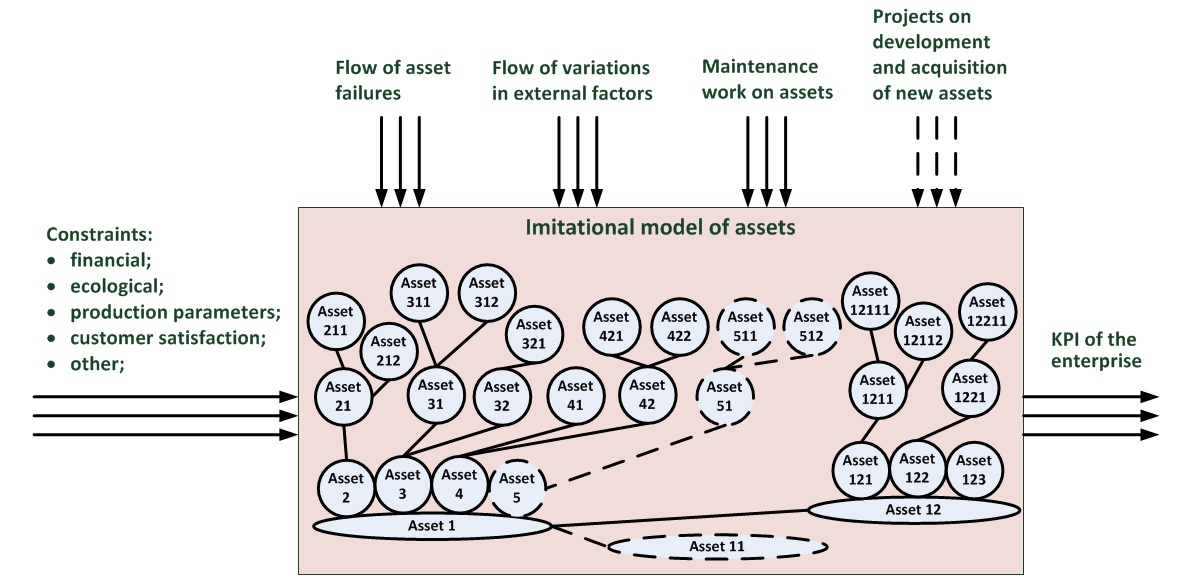

Imitational model of assets allows to forecast KPI of the enterprise in regards to both – execution of maintenance work on the existing assets as well as execution of projects on development, acquisition, and exploitation of new assets. In other words, the model considers not only existing assets, but also potential assets that can be put into production through development and/or acquisition.

During imitational modeling, technological links between the assets are considered, i.e. when a certain asset breaks the model projects the effect of malfunction onto all technologically connected assets, manufacturing levels, customer delivery services, etc.

The results of imitation are affected by modeling the stream of breakages and by modeling the stream of external changes. The stream of breakages is modeled based on historical stats collected by the client or presented by a manufacturer of a certain item. The stream of external changes is modeled based on various economical forecasts and includes such items as inflation, financial/economical crisis, payroll hikes, competing markets, etc. On its input, the model also receives constraints that must be observed for proper functioning of the business. During modeling such constraints are constantly checked, and, if violated, the information is reflected within the results of the run.

As its modeling subjects, the model considers whole functional objects that reflect major steps within production processes. The representation set of assets that is used for modeling is well suited for imitational modeling purposes and does not match with other representations of the same assets such as in accounting, technical support, or maintenance. Asset data for imitational modeling can be uploaded from the System of Master Data Management of Assets or prepared and entered by the users manually.

This product is going to be used as a tool for forecasting enterprise’ KPI in various situations of budget allocation on asset maintenance and/or creation. However, it can also be used for various tasks of asset management including:

- ROI maximization of the assets

- Accounting, planning, analysis, and streamlining of expenditures towards maintenance of the assets

- Risk management within the area of asset management

- Defining a well balanced program of technical reconstruction and development

- Providing well-taken capital-output ratio of manufacturing assets

- Providing the flexibility of fixed assets that allows adapting to fluctuations in external environment, market situation, technical and technological innovations